How To Reconcile In Quickbooks Online

How To Reconcile In QuickBooks Online: Step-by-Step Guide for Accurate Bookkeeping

Reconciling your accounts regularly is essential for maintaining accurate financial records and ensuring your QuickBooks Online data matches your bank statements. If you’ve ever wondered how to reconcile in QuickBooks Online, this comprehensive guide will walk you through each step, share practical tips, and highlight the benefits of regular reconciliation.

What Is Reconciliation in QuickBooks Online?

Account reconciliation is the process of comparing your QuickBooks Online transactions against your bank or credit card statements to confirm that the amounts match. This helps identify discrepancies caused by data entry errors, missing transactions, or fraudulent activity.

Why Is Bank Reconciliation Important?

- Accuracy: Ensures your books reflect the true financial status of your business.

- Fraud Detection: Helps spot unauthorized transactions quickly.

- Better Cash Flow Management: Provides an accurate view of available funds.

- Tax Preparedness: Keeps your records ready for tax filings and audits.

Step-by-Step Process: How To Reconcile in QuickBooks Online

Follow these simple steps to complete your reconciliation efficiently:

Step 1: Gather Your Bank Statement

Before starting, have your bank or credit card statement ready. You’ll need the statement’s ending balance and the ending date for the reconciliation period.

Step 2: Access the Reconciliation Feature in QuickBooks Online

- Log in to your QuickBooks Online account.

- Navigate to the left sidebar menu and click Accounting.

- Select Reconcile under the “Accounting” section.

Step 3: Select the Account to Reconcile

Choose the bank or credit card account you want to reconcile from the drop-down menu.

Step 4: Enter Statement Information

Input the Ending balance and Ending date exactly as they appear on your bank statement. This sets the basis for matching your records.

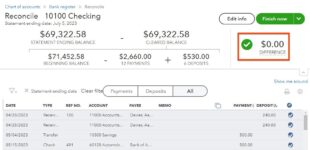

Step 5: Review and Match Transactions

QuickBooks will display a list of downloaded and manually entered transactions. Compare each one with your statement:

- Check off transactions that match your bank statement.

- If you find missing transactions, add them to QuickBooks before continuing.

Step 6: Resolve Discrepancies

If the difference between your bank statement and QuickBooks is not zero, investigate:

- Look for duplicate or missing entries.

- Verify amounts and dates.

- Edit incorrect transactions.

Step 7: Finish the Reconciliation

Once the difference reads zero, click Finish now to complete the process. QuickBooks saves the reconciliation report for your records.

Common Issues During QuickBooks Online Reconciliation & How to Fix Them

| Issue | Cause | Solution |

|---|---|---|

| Difference doesn’t reach zero | Missing or duplicate transactions | Add missing transactions or delete duplicates |

| Uncleared transactions from previous periods | Transactions not reconciled properly | Review prior reconciliations and correct mistakes |

| Incorrect beginning balance | Previous reconciliation errors | Undo last reconciliation or adjust opening balance |

Practical Tips for Successful Reconciliation in QuickBooks Online

- Reconcile monthly: Avoid backlog by scheduling reconciliation each month.

- Use bank feeds: Connect your bank for automatic transaction imports.

- Keep notes: Document reasons for adjustments or discrepancies for future reference.

- Make backups: Export reconciliation reports regularly for safe keeping.

Benefits of Regular Reconciliation in QuickBooks Online

Consistently reconciling your accounts empowers you with trustworthy bookkeeping data. Key benefits include:

- Minimized bookkeeping errors: Early detection prevents costly mistakes.

- Improved financial decisions: Accurate data fuels confident budgeting and forecasting.

- Streamlined audits and tax filing: Saves time and reduces stress during tax season.

Real-Life Example: How Reconciliation Saved a Small Business

Jane, a small business owner, noticed her QuickBooks balance didn’t match her bank statement for months. After dedicating time to reconcile her QuickBooks Online accounts monthly, she uncovered duplicate payments and a few unauthorized transactions. Catching these early allowed Jane to avoid overdraft fees and set better financial controls in place, strengthening her business’s cash flow management.

Conclusion

Knowing how to reconcile in QuickBooks Online is a foundational skill every business owner or bookkeeper should master. Reconciliation keeps your financial data accurate, helps detect errors or fraud, and improves overall accounting processes. By following the step-by-step approach outlined above and applying best practices, you can maintain clean, reliable books that support your business growth.

Start reconciling today – your future self (and your accountant) will thank you!