Shopee Loan Interest Rate: What You Need to Know in 2024

If you’re an avid Shopee shopper or a seller on the platform, you might have come across Shopee Loan-a convenient financial service designed to support your purchasing or business needs. One of the most critical aspects you’ll want to understand before applying for a Shopee Loan is the interest rate. This comprehensive guide breaks down everything about Shopee Loan interest rates, how they work, and practical tips to make the most out of your loan experience.

What Is Shopee Loan?

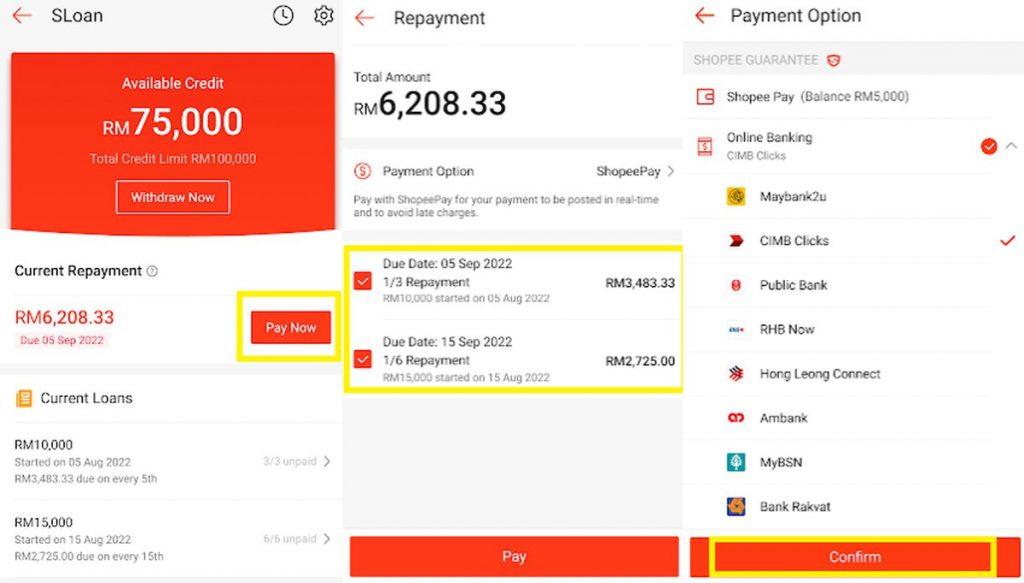

Shopee Loan is a virtual credit product provided by Shopee exclusively in partnership with select financial institutions. The loan is tailored primarily for Shopee users who need quick financial support to either increase their buying power for shopping or to grow their business via Shopee’s ecommerce platform.

Unlike traditional bank loans, Shopee Loan application is fully digital and integrated into the Shopee app, making it fast, user-friendly, and accessible for millions of users nationwide.

Understanding Shopee Loan Interest Rates

The Shopee Loan interest rate refers to the percentage charged on the outstanding loan amount for borrowing money through the Shopee Loan program. This rate can vary depending on factors such as the loan type, tenure, borrower profile, and prevailing market conditions.

Here are the key points to note about Shopee Loan interest rates:

- Interest Rate Range: Typically, Shopee Loan interest rates range from 0.8% to 3% per month, equivalent to an annual percentage rate (APR) of approximately 9.6% to 36%.

- Variable Rates: Depending on your credit score and loan conditions, the interest rate may fluctuate.

- No Hidden Fees: Shopee maintains transparency on charges, but always check for any processing fees or late payment penalties.

Current Shopee Loan Interest Rates in 2024

Shopee partners with licensed lenders to offer competitive interest rates. Here’s a quick comparison of the average Shopee Loan interest rates available in 2024:

| Loan Type | Interest Rate (Monthly) | Loan Tenure | Remarks |

|---|---|---|---|

| Personal Loan (via Shopee Finance) | 1.0% – 2.5% | 3 – 12 months | Flexible repayment plans |

| Business Loan for Sellers | 0.8% – 2.0% | 3 – 24 months | Competitive for high-volume sellers |

| Installment Plans (for purchases) | 0% – 1.5% | 1 – 6 months | Promo periods with 0% interest |

How Shopee Loan Interest Is Calculated

Shopee Loan interest is commonly calculated using one of the two methods:

- Flat Interest Rate: Interest is calculated on the original principal amount throughout the loan tenure.

- Reducing Balance Method: Interest is charged on the outstanding balance after every payment, which reduces over time.

Most Shopee installments and loans use the reducing balance method for fairness to borrowers. Be sure to check your loan agreement before committing.

Benefits of Shopee Loan

Taking a loan through Shopee comes with unique advantages, including:

- Quick and Convenient: Seamless application and approval within the Shopee app.

- Flexible Repayment Options: Multiple repayment tenures to suit your budget.

- Transparent Interest Rates: Clear display of rates and fees upfront.

- Access to Promotions: Many loans come with 0% interest promo periods.

- Improved Credit History: Responsible repayment can help build your credit score.

Practical Tips for Managing Your Shopee Loan Interest Rate

Successfully managing your Shopee Loan interest rate can help you save money and avoid penalties. Here are some practical tips:

- Choose the Shortest Tenure That Suits You: Shorter tenures usually mean lower total interest paid.

- Make Timely Payments: Avoid late fees or rate hikes by sticking to your repayment schedule.

- Monitor Loan Promotions: Take advantage of zero or reduced interest rate promotions.

- Understand the Terms: Carefully read the loan agreement to understand how interest is calculated and any additional fees.

- Use Loans Judiciously: Borrow only what you need to avoid unnecessary financial burden.

Frequently Asked Questions (FAQs)

1. Is the Shopee Loan interest rate fixed or variable?

Shopee Loan interest rates may be fixed for your loan tenure or variable based on your borrower profile and lender policies. Typically, installment loans come with fixed rates, while others may vary.

2. Can I prepay my Shopee Loan without penalty?

Many Shopee Loan providers allow prepayment without penalties, but it’s important to confirm before applying. Prepaying can save you interest costs.

3. How is Shopee Loan different from a traditional bank loan?

Shopee Loan offers faster processing, primarily online application, and tailored financing options for Shopee users, whereas traditional bank loans often require longer paperwork and stricter credit checks.

Conclusion

Understanding the Shopee Loan interest rate is essential before deciding to borrow through this convenient financial service. By knowing how the interest rates work, the factors that influence them, and practical tips to minimize costs, you can leverage Shopee Loan effectively-whether for personal expenses or growing your Shopee business.

Make sure to compare rates, read terms carefully, and plan your repayments responsibly to make the most out of your Shopee Loan experience in 2024 and beyond!

If you’d like to explore more about Shopee Loan offers and updates, keep an eye on Shopee’s official app and announcements to grab the best deals and promotions.